Many successful investors have more than a keen eye for potential deals or an innate sense of when to sell and when to hold. Savvy rental property owners know that adopting modern tools to stay organized, manage efficiently, and streamline previously tedious tasks can be a game-changing decision.

That’s where real estate investor software comes into the picture.

These tools can be used to analyze the potential financial performance of a rental property and to monitor the income and expenses, cash flow , and net income of assets, ideally at both the property and portfolio levels.

Choosing the best software for your rental property portfolio can help make the difference between investments that barely break even versus those that generate solid, consistent, positive cash flow year after year.

There’s a diverse set of tools out there that can assist landlords in numerous ways, including:

In this article, we’ll explore some of the most effective software solutions to help you keep your investments in order, increase NOI, and save precious time on administrative work.

The software that’s best for one property owner isn’t always best for another. Property types are different and investment strategies vary. With that in mind, here are some of the most essential features to look for when evaluating real estate investment software:

Stessa is a comprehensive platform designed to serve the diverse needs of rental property investors. It boasts a community of over 200,000 users, from novice real estate owners to seasoned property professionals.

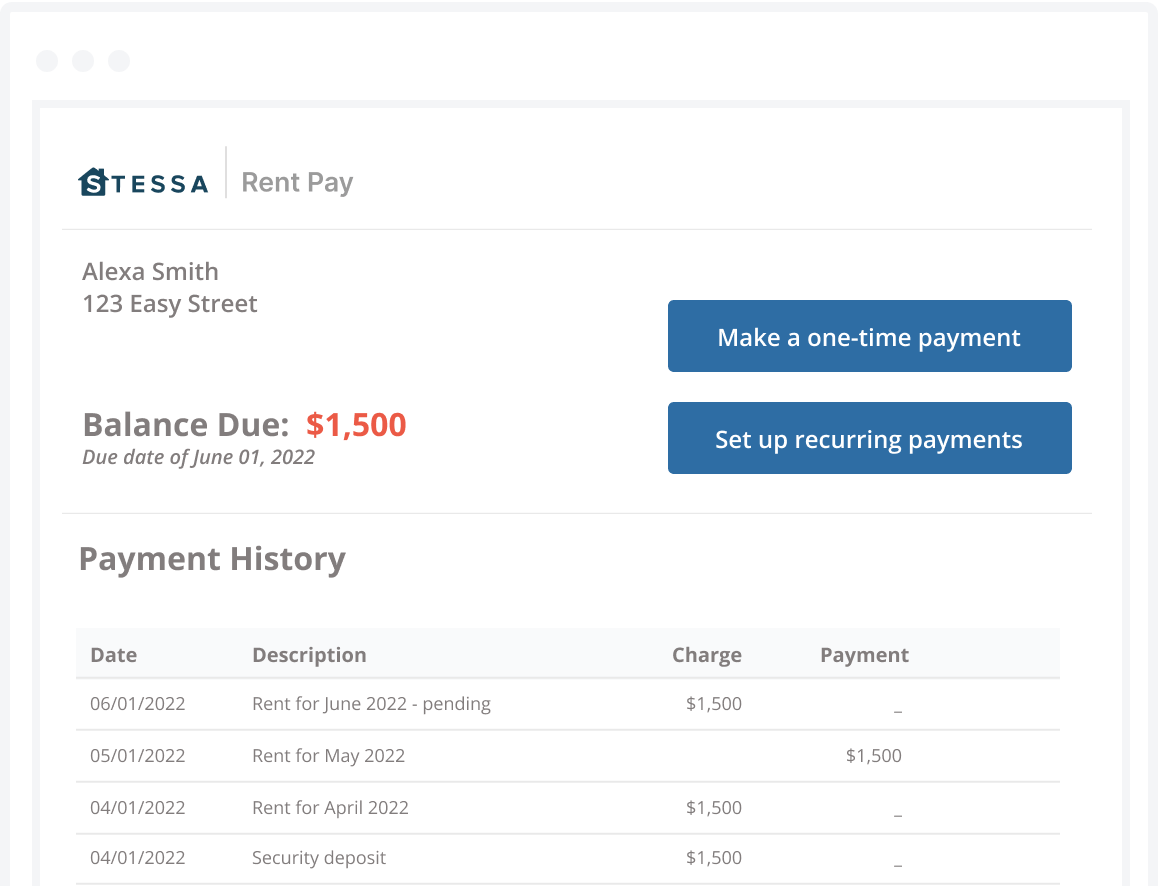

The software simplifies property management, helping eliminate the daily busywork created by tedious manual tasks. It offers automated accounting, real-time financial reporting, and support for a wide range of rental property types, including single-family homes, multifamily units, and short-term rentals.

Setting up a property on Stessa is free, quick, and user-friendly. You simply input the rental property address, link your business bank accounts, and then generate comprehensive financial reports such as income statements, Schedule E, and net cash flow. Users have reported saving up to an average of $4,000 and over 100 hours annually, making it an excellent choice for efficient property management.

Along with property management tools, Stessa provides automated income and expense tracking and personalized reporting at both the property and portfolio levels. Additional features designed to maximize returns through intelligent financial management include:

For even more financial management capabilities, you can open Stessa Cash Management deposit accounts for each property and easily integrate them into the platform. Unlock real-time financial insights and built-in expense management with no minimum balance requirements and no fees for bounced checks, inbound wire transfers, or monthly maintenance. Plus, these accounts boast interest rates significantly higher than the national average.

With Stessa, property investors gain a comprehensive management tool and an opportunity to make their money work harder for them.

Stessa created its tiered pricing structure carefully to accommodate the diverse requirements and budgets of owners of residential rental properties.

Here’s a breakdown of features offered in various Stessa plans:

| Essentials | Manage | Pro | |

|---|---|---|---|

| PRICING | |||

| Free | $15/month ($12/mo when paid annually) | $35/month ($28/mo when paid annually) | |

| ASSET MANAGEMENT | |||

| Track properties | Unlimited | Unlimited | Unlimited |

| Dashboards | Key metrics only | Key metrics only | Full chart history |

| Property manager connections | Unlimited | Unlimited | Unlimited |

| Document & receipt storage | Unlimited | Unlimited | Unlimited |

| Organize & manage portfolios | 1 | 1 | Unlimited |

| Shared account access | Yes | Yes | Advanced ownership metrics |

| BOOKKEEPING/ACCOUNTING | |||

| Advanced transaction tracking | No | No | Yes |

| Smart receipt scanning | 5/month | 5/month | Unlimited |

| Manual expense tracking | Yes | Yes | Yes |

| Automated bank feeds | Unlimited | Unlimited | Unlimited |

| Budgeting & pro-forma analysis | No | No | Yes |

| Project expense tracking | No | No | Yes |

| REPORTING & TAXES | |||

| Reporting level | Basic | Basic | Advanced |

| Full data export | Yes | Yes | Yes |

| Accountant tax package | Basic | Plus Schedule E | Plus CapEx |

| BANKING | |||

| High yield Cash Management | 3.14% APY* | 3.14% APY* | 5.09% APY* |

| FDIC insured up to $2.5M/entity | Yes | Yes | Yes |

| No minimum balance | Yes | Yes | Yes |

| 1.1% cash back on purchases | Yes | Yes | Yes |

| ONLINE RENT COLLECTION | |||

| Accelerated rent payments | No | Coming Soon | Yes |

| Automated reminders and late fees | Yes | Yes | Yes |

| Tenant autopay | Yes | Yes | Yes |

| Tenant ledger and rent roll | Yes | Yes | Yes |

| Tenant ACH fee waived | No | No | Yes |

| LEASING | |||

| Vacancy advertising | Yes | Yes | Yes |

| Syndication to Zillow | Yes | Yes | Yes |

| Tenant applications & screening | Yes | Yes | Yes |

| Lease template | No | Yes | Yes |

| DOCUMENT MANAGEMENT | |||

| eSign leases, contracts, etc. | No | 1/month | 7/month |

| 60+ Forms and templates | No | Yes | Yes |

| CUSTOMER SUPPORT | |||

| Basic support | Yes | Yes | Yes |

| Priority chat support | No | Yes | Yes |

| Live phone support | No | No | Yes |

| Get Started | Get Started | Get Started |

DealMachine is a highly-rated app for real estate investors with several features to facilitate sourcing and underwriting of potential investment targets. It offers multiple software plans, generally based on per user pricing.

Key features

Who is this tool ideal for?

Valuate by REFM is a software solution for multifamily core and value-add real estate investors. It allows you to model properties from the rent roll through unit renovations, refinancing, and sale.

Key features

Who is this tool ideal for?

RealData is designed to help real estate investors and developers make informed decisions. The company offers multiple products, including REIA Express for small residential investors and REIA Professional for investors with large portfolios.

Key features

Who is this tool ideal for?

CRE Tech recognized TheAnalyst PRO as the leading investment modeling software. It includes lease analysis, demographics, and offering memorandums, catering to professional real estate investors who need detailed analysis quickly.

Key features

Who is this tool ideal for?

RealNex is an all-in-one platform that combines real estate analytics, marketing and lead management, and customer relationship management (CRM). It’s used by brokerage firms, investment brokers, leasing agents, property owners, and asset managers with medium and large-sized property portfolios.

Key features

Who is this tool ideal for?

ProAPOD offers two real estate investment software solutions to help you start, build, and scale a rental property business. The software allows investors to calculate cash flow and rate of return and generate pro formas for residential multifamily and commercial properties.

Key features

Who is this tool ideal for?

PropertyMetrics is a web-based software solution specifically designed for commercial real estate investors. It provides an easy-to-use platform for creating, analyzing, and sharing a detailed cash flow pro forma, performing discounted cash flow analysis, and generating comprehensive reports.

Key features

Who this tool is ideal for:

PropertyTracker offers two online tools, Property Evaluator and Property Tracker, to streamline real estate investment management. Property Evaluator helps compare properties based on professional indicators, while Property Tracker helps monitor key financial metrics for smarter management decisions.

Key features

Who is this tool ideal for?

Real Estate Analysis Software, LLC offers Cash Flow Analyzer Pro Software for long-term rental investors and Flipper and Rehabber Pro Software for house flippers and rehabbers. These tools simplify deciding whether to buy, sell, or keep looking for real estate investment opportunities.

Key features

Who is this tool ideal for?

Rehab Valuator is a comprehensive tool for rehabbers, house flippers, and wholesalers. It assists in calculating offers and analyzing deals, sharing deals with buyers, creating deal-funding presentations, and managing projects and budgets.

Key features

Who is this tool ideal for?

REIPro offers an all-in-one solution for real estate investors, featuring a real estate CRM, MLS comparable sales, a deal analyzer, a quick property information lookup, a premium phone number search, and ongoing education. The software caters to all property types, from single-family homes to large commercial properties.

Key features

Who is this tool ideal for?

Zilculator is a software solution designed for residential real estate investors. It automates property analysis by pulling data from the MLS, Zillow, and Rentometer to create professional-grade investment reports in minutes.

Key features

Who is this tool ideal for?

*Pricing does not reflect promotional offers.

Argus offers software solutions for a wide range of real estate professionals, including owners and investors, asset and portfolio managers, fund and investment managers, and property developers. The software aids in valuations and cash flow analysis, scenario and risk analysis, budgeting, and strategic planning.

Key features

Who is this tool ideal for?

*Stessa is not a bank. Stessa is a financial technology company. Terms and conditions, features and pricing are subject to change. This article, and the Stessa Blog in general, is intended for informational and educational purposes only, and is not investment, tax, financial planning, financial, legal, or real estate advice.